What is matching expenses with revenue concept? Typically, revenue is recognized when a critical event has occurred, and the dollar amount is easily measurable to the company.

Matching principle accounting how to#

Revenue recognition is a generally accepted accounting principle ( GAAP ) that identifies the specific conditions in which revenue is recognized and determines how to account for it. What is the concept of revenue recognition? In cash accounting – in contrast – revenues are recognized when cash is received no matter when goods or services are sold. Second, revenue must be realizable, that is, cash is received or the amount to be received can be measured.Īccording to the principle, revenues are recognized when they are realized or realizable, and are earned (usually when goods are transferred or services rendered), no matter when cash is received. First, revenue must be earned, that is, the earnings process is either complete or virtually complete. Revenue is recognized when two basic criteria are met. GENERAL CRITERIA FOR REVENUE RECOGNITION.

What are different criteria for recognizing revenue?

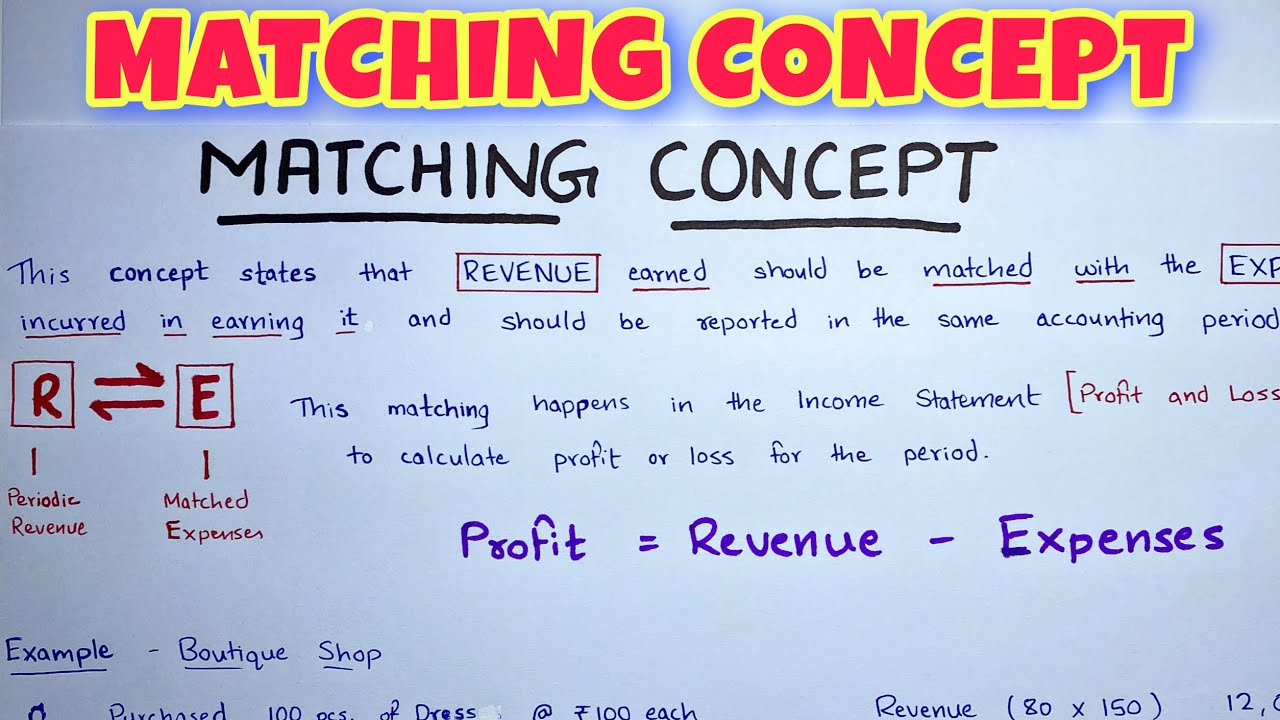

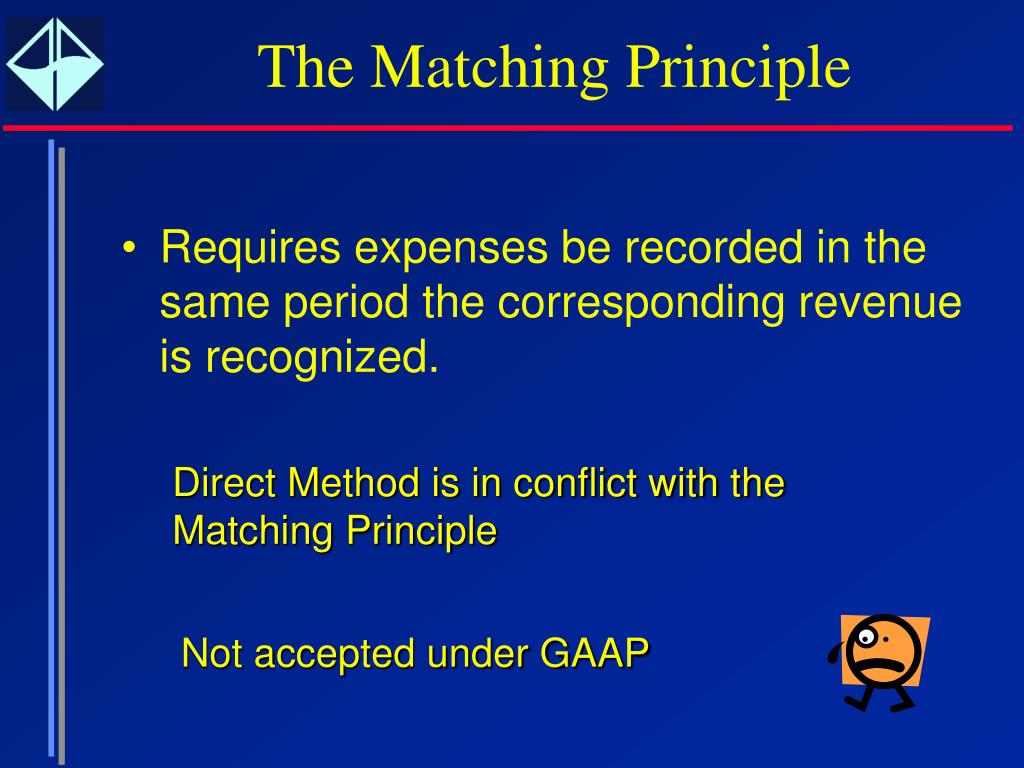

The method follows the matching principle, which says that revenues and expenses should be recognized in the same period. What is the difference between matching concept and accrual concept?Īccrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs rather than when payment is received or made. Step 4 – Allocate the Transaction Price.Step 3 – Determine the Transaction Price.Step 2 – Identify Performance Obligations.The FASB has provided a five step process for recognizing revenue from contracts with customers: What are the five steps to revenue recognition? Recognizing the expenses at the wrong time may distort the financial statements greatly and provide an inaccurate financial position of the business. The primary reason why businesses adhere to the matching principle is to ensure consistency in financial statements, such as the income statement, balance sheet etc. Why is it important to apply the matching principle and the revenue recognition principle? The profit or for a period of time (e.g., a year, quarter, or month). Revenues and expenses are matched on the income statement.

In accounting, the terms “sales” and they are related to. The matching principle is an accounting concept that dictates that companies report expenses. Earned revenue accounts for goods or services that have been provided or performed, respectively. The revenue recognition principle, a feature of accrual accounting, requires that revenues are recognized on the income statement in the period when realized and earned-not necessarily when cash is received. The matching principle helps management record EXPENSES at the proper amount and in the proper accounting period. The revenue recognition principle helps ensure that management reports REVENUES at the proper amount and in the correct accounting period. What is the difference between matching principle and revenue recognition principle? 5 What are different criteria for recognizing revenue?.4 What is the difference between matching concept and accrual concept?.2 What is revenue recognition principle?.1 What is the difference between matching principle and revenue recognition principle?.

0 kommentar(er)

0 kommentar(er)